Sam Bankman-Fried, the founder of FTX and former CEO, spoke with New York Times and CNBC host Andrew Ross Sorkin in a highly anticipated interview on Wednesday that had been booked before FTX imploded. And it was a master class in spin.

Bankman-Fried, more commonly known as SBF, joined virtually from the Bahamas and spent the interview repeatedly adopting the posture and cadence of a 15-year-old kid caught with a baggie of weed in his sock drawer. But SBF wasn’t caught smoking weed by his parents and he’s not a teenager. The 30-year-old graduate of MIT lost billions of dollars in user deposits — the life savings of regular people, in some cases — on his crypto trading platform FTX, a company that had a valuation of $US32 ($44) billion before declaring bankruptcy on November 11.

SBF has spent the past three years building a personal brand that mixes the laid-back, hoodie-wearing techie of early-Facebook Mark Zuckerberg with the single-minded focus of a number cruncher like Michael Burry, played by Christian Bale in 2012’s The Big Short. Toss in some heavy use of prescription uppers and you’ve got a boy genius who just wants to make the world a better place with his magic internet money.

That image of the brilliant child was touted on magazine covers, during TV interviews, and at conferences where SBF was wearing shorts and a t-shirt while sitting next to former British Prime Minister Tony Blair and former U.S. president Bill Clinton. And it allowed SBF to create an empire built on fake money, in the form of not just bitcoin and ethereum but two cryptocurrencies he created himself called FTT and Serum. SBF used this junk as collateral to make large bets with his hedge fund Alameda Research, and it was those bad bets, made by taking customer deposits through a technique known in the legal profession as “fraud,” which ultimately led to the company’s downfall in a spectactularly short period of time.

Sorkin got in plenty of questions during the 1 hour and 13-minute conversation, but SBF was almost always able to make it sound like he was just making honest mistakes. Sorkin asked SBF about the co-mingling of funds between FTX and Alameda Research, an entity he technically wasn’t supposed to have any control over. But even some of Sorkin’s questions were infantilising and allowed viewers to empathise with the idea that SBF was little more than a child who got in over his head.

“When you read the stories, it sounds like a bunch of kids who were on Adderall having a sleepover party,” Sorkin said to laughter from the audience in New York.

“Look, I screwed up. I was CEO. I was the CEO of FTX. And, I say this again and again, that…. that means I had a responsibility, that I was responsible ultimately for us doing the right things. I mean, we didn’t. We messed up big,” Bankman-Fried said, his head hanging low.

And that conciliatory tone was part of a constant refrain that, in truth, landed like a weaponised apology. SBF would take responsibility, or at least look like he was taking responsibility, and say that he simply messed up by not managing risks properly. And it all came across as something we could empathise with. Sorkin would then go on to ask about SBF’s parents, both law professors at Stanford.

“Your parents are law professors. What did you tell them when all of this happened?” Sorkin asks at one point.

Putting aside the vague phrasing in a line like “when all of this happened,” for a second, who gives a shit what SBF’s parents think of the situation? Try to imagine literally any other person accused of criminal-level impropriety with customer funds getting asked a softball question more in line with junior high gossip. To his credit, Sorkin also asked about the real estate purchases in the Bahamas that SBF’s parents were apparently signatories on — a question SBF didn’t provide a very clear answer, much like the rest of the interview. But SBF was clearly granted leeway in a manner that’s hard to imagine someone like Elizabeth Holmes getting in the aftermath of the fraud at Theranos, to say nothing of a Ponzi scheme character like Bernie Madoff.

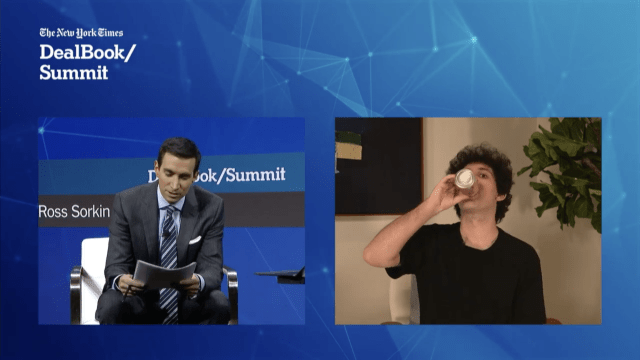

Even SBF’s repeated drinks of some canned beverage helped created the subtle image that this was a juvenile who couldn’t really be held responsible for his actions. And it’s hard not to imagine that impression was deliberate, much like the rest of his slovenly persona.

The interview even ended with a round of applause for SBF from the audience — people who reportedly paid over $US2,000 ($2,776) a head for the chance to attend the conference in New York. It was a very weird moment from the audience, perhaps only exceeded when they all laughed at SBF saying he “had a bad month,” as though it was a line from a sitcom.

Maybe it was all best summed up by Kevin O’Leary, a former paid spokesman for FTX who also lost money during the implosion of FTX. O’Leary quote-tweeted Bill Ackman on Wednesday, who said he believed SBF after watching the interview, suggesting perhaps that it was all a bunch of honest mistakes.

“I lost millions as an investor in @FTX and got sandblasted as a paid spokesperson for the firm but after listening to that interview I’m in the @BillAckman camp about the kid!” O’Leary tweeted.

The kid. The 30-year-old kid.

George Stephanopoulos of ABC News recently flew down to conduct his own interview with SBF in the Bahamas, which is expected to air on Good Morning America on Thursday morning. But here’s hoping old George will squeeze some actual news out of his interview. Because while Sorkin’s interview on Wednesday may provide some opportunities for eagle-eyed lawyers hoping to catch SBF in some contradictions, it was clearly an attempt by SBF to manipulate the narrative by appearing to offer contrition for the collapse of FTX, while getting away with a gentle slap on the wrist because he’s just a young 30-year-old boy, after all. The idiotic boy genius.