The trial of FTX founder Sam Bankman-Fried reached its halfway point, and a flurry of incriminating evidence, emotional testimonies, and odd tales have surfaced in the last three weeks.

The U.S. Department of Justice charged SBF with defrauding customers out of billions of dollars between 2019 and 2022. FTX crashed in November 2022 after Coindesk reported on the company’s questionable balance sheet and odd relationship with Alameda Research. The crash sank the cryptocurrency market, which one year later has yet to fully recover. FTX filed for bankruptcy soon after, and SBF was arrested in his Bahamas home in December 2022.

Here are the biggest moments you need to know about in cryptocurrency’s most high-profile legal battle.

Caroline Ellison Gets Personal

Caroline Ellison, CEO of Alameda Research and former girlfriend of Sam Bankman-Fried, emerged as the prosecution’s star witness. She’s pleading guilty, and trying to reduce her sentence by shifting as much blame as possible onto Sam Bankman-Fried. Her testimony created a side narrative regarding the explosive demise of their relationship. She’s dropping bombshells on the man who leaked her diary in order to discredit her testimony, and it could help land SBF in prison for life. Ouch.

SBF Requests More Adderall

Bankman-Fried’s defense team wrote to the court asking for a higher, longer-lasting dose of Adderall to ensure his ability to testify. The defense complained that the dosage the FTX founder was receiving was wearing off before the trial had even begun, so he couldn’t focus on the case. SBF’s lawyer Mark Cohen asked to adjourn the trial until the medicine could be secured.

Judge Kaplan denied the request to adjourn the trial but approved the request for a longer-lasting dose. He observed the FTX founder was doing just fine focusing on the trial. He added, “I can’t have lawyers giving drugs to people on trial.” Good call.

FTX CTO Gary Wang Points to the Code Behind the Alleged Crime

Gary Wang, cofounder and chief technology officer for FTX, focused on a single piece of code during his testimony: “allow_negative.” SBF did not code at FTX, so Wang was responsible for orchestrating all of the technical changes at the company. The code “allow_negative” allowed for Alameda Research’s balances to be negative, a somewhat uninspired name that was never meant for the public’s eyes.

The code basically allowed Alameda Research to have an infinite line of credit, which was ultimately paid by FTX customer funds. In the end, Alameda borrowed $US14 billion from FTX, an amount it couldn’t repay. Alameda was always framed by SBF as a liquidity provider in the crypto world, but really, FTX customers were providing the liquidity. This is a key piece of the prosecution’s case, and Wang pointed to the software in place that allowed it to happen.

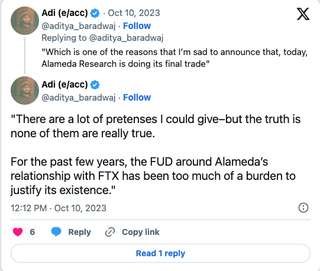

There Were Internal Drafts to Close Alameda Research

An unpublished press release from SBF saying he was shutting down Alameda Research was made public during the trial. The threads posted on X, formerly Twitter, on Oct. 10 show a coordinated plan in place to shut down Alameda because of fear, uncertainty, and doubt surrounding the relationship between SBF’s companies. That’s what the planned press release said, at least, but the prosecution has certainly shown a few more legitimate reasons why Alameda wasn’t the best company. It’s unclear why the planned tweet thread was never published, but the posts made clear that there was coordinated concern on SBF’s part as well.

FTX Had ‘Creative’ Balance Sheets

When Ellison sent SBF Alameda’s rocky balance sheets in mid-2022, he asked her to find “alternative ways of presenting the information.” Ellison was able to find some creative accounting methods to make Alameda’s financials look less risky. Those balance sheets were ultimately sent over to Genesis Trading, which is involved in another crypto fraud case from around the same time period.

Nishad Singh Gives the Defense a Lay-Up

FTX’s head of engineering Nishad Singh delivered a surprisingly emotional testimony earlier this week revealing he felt “betrayed” by Bankman-Fried as a longtime friend of the family. Singh was late to learn about the conspiracy, finding out just two months before the world did, but he stayed on to help steer the sinking ship.

However, Singh’s heartfelt testimony crumbled under cross-examination, allowing for a rare win for SBF’s defense. FTX’s determined do-gooder had his credibility brought into question when the defense pointed out that Singh took out a loan from FTX in order to buy a $US3.7 million house on Orcas Island in Washington after Singh says he found out about the misuse of customer funds. The defense briefly found its footing here, and this may be a sign of how they plan to disperse the blame.

Saudi Crown Prince Mohammed Bin Salman’s Cameo

One particularly damaging detail Ellison dropped was that FTX considered raising emergency funding from Saudi Crown Prince Mohammed bin Salman. The mere consideration rings alarm bells, showing just how dire things were at FTX.

BlockFi Shows How to Collapse ‘The Right Way’

BlockFi, another crypto lender, was forced to declare bankruptcy because of Alameda Research. That’s the story BlockFi CEO Zac Prince told when he took the stand in SBF’s trial. BlockFi loaned Alameda Research billions of dollars, but never got all of it back, forcing Prince’s company into bankruptcy.

Prince’s testimony was notable because BlockFi explicitly told customers in more ways than one that it was lending and investing with customer funds. That’s a key distinction between BlockFi and FTX. There’s nothing illegal about investing customer dollars—that’s how banks make a profit—but exposing customers to risk without telling them of potential fraud.

The Badass Accountant, Peter Easton

Peter Easton easily snagged the title of coolest accounting professor for his testimony this week. A huge question of this trial was where did the $US9 billion in misappropriated customer funds go. Easton, a Notre Dame forensic accountant, painted a picture of where the money had been dispersed. Customer funds had been reinvested into businesses and real estate, used to make political contributions, and donated to charity.

Easton pointed to specific companies and people who took the money and provided evidence for why SBF must have known they were dipping into customer funds. Simply put, there was no money anywhere else.

So, Where Do We Go From Here?

Despite a powerful case by the prosecution painting a picture of the alleged fraud at FTX, the trial is far from over. With three weeks to go, we still have to hear from the defense, and there are several key people who could be brought into the courtroom.

One person is Sam, himself. SBF did a wild press blitz right when FTX collapsed, but we haven’t heard much from the man since then. Another duo we could hear from are SBF’s parents, who were gifted significant amounts of money that may involve them in this case as well. Nevertheless, the case has a long way to go.